Educators throughout Minnesota are starting to see their loans forgiven through the federal Public Service Loan Forgiveness program, thanks to recent waivers and changes from the Biden administration and the work of both our national unions.

From now until October 2022, the U.S. Department of Education will be waiving two of the four PSLF requirements. The first is that qualifying payments had to be made under an income-driven repayment plan. The second is that only payments made on Direct Loans could count towards PSLF qualification.

Education Minnesota’s Degrees, Not Debt program has been supporting members through the loan forgiveness process for years and continues to support those who are navigating the recent changes.

Education Minnesota’s Degrees, Not Debt program now has an online training available on the expansion of loan forgiveness options and the steps educators have to do in order to take advantage of this program.

Educators can access the training on the free professional development platform, MEA Online. Search the catalog for “Degrees Not Debt.”

By taking the training, those wanting support for loan forgiveness questions will have a solid foundation to understand options and from which to ask questions.

In general, an educator’s ability to access and/or apply for forgiveness is going to be dependent on a number of factors. There are a few options for loan forgiveness out there, but each come with a different set of eligibility standards, which is why Education Minnesota suggests taking the online training to start the process.

Once the training is complete and you have found your federal loan information on studentaid.gov, Education Minnesota staff can help guide you throughout the whole process.

Find out more about the union’s Degrees, Not Debt program at www.educationminnesota.org/advocacy/degrees-not-debt.

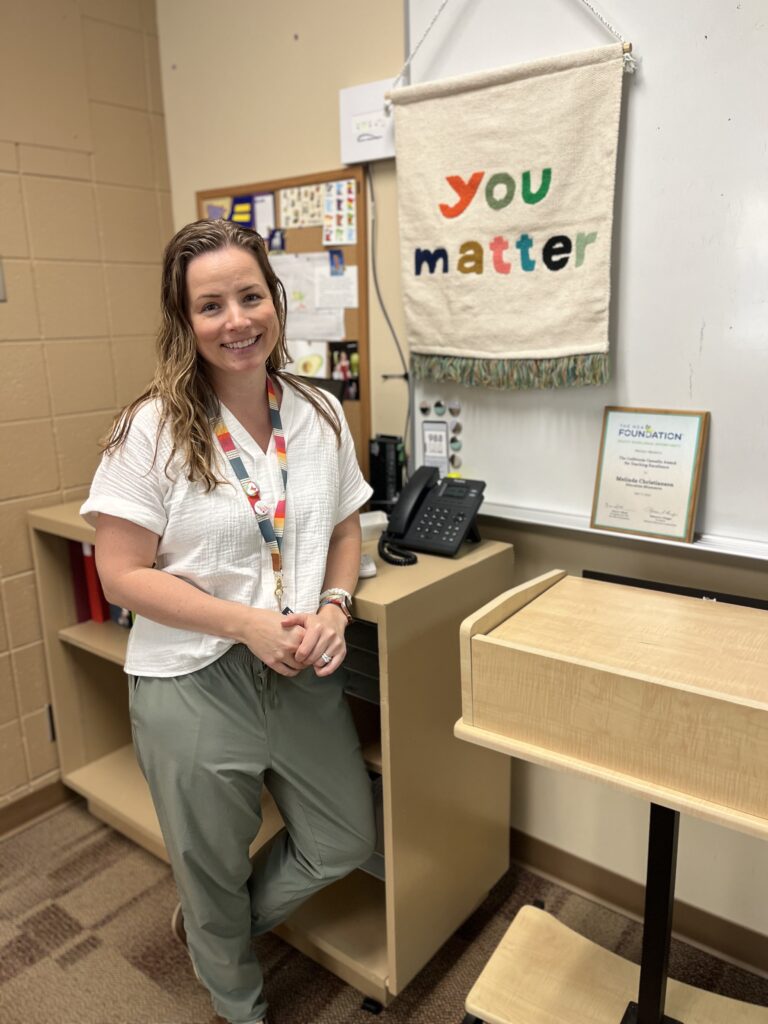

Britt Pennington – More than $51,000 forgiven

Britt Pennington, a licensed school counselor currently working as a mental health professional in Intermediate School District 917, had been pursuing PSLF since 2010 to pay off her grad school debt. She recently had her loans forgiven, a total which was more than her original loan.

“My loans were all from grad school, where I ended with about $50,000 in debt,” she said. “I got started on the forgiveness process right away, paid every year since 2010 and I had more forgiven than I had originally owed — more than $51,000.”

Pennington knows she is not the only educator with a story of owing more than her original loan amount, or a story about her loan servicers not being helpful.

“I used to take notes when I called my servicer. They were not helpful,” she said. “I was told one thing by one person and one thing by another person. I was given so much false information. At one point, I switched to a different incomed-based payment plan. I verified that I submitted everything, and then out of the blue, I got a call saying I missed some paperwork and was being put on deferment. Because of that, those months that I had to spend fixing it wouldn’t count toward my PSLF. But I had confirmed and specifically asked that I had everything done correctly.”

Pennington didn’t have to do anything differently because of the new waivers, as her 120 payments naturally coincided with the changes this fall. But she was still denied at first when she submitted her application.

“I was denied because it said I didn’t work for a qualified employer, even though I had submitted all of the employment paperwork that says I do,” she said. “I submitted the paperwork again and regularly logged in to check the status.”

One day, Pennington logged in and the website showed a zero.

“It was surreal,” she said. “I hadn’t gotten the physical letter yet, but the electronic version was on the website. I started telling everyone.”

Having her loans forgiveness is an incredible weight off her shoulders, said Pennington.

“The process probably took years off my life,” she said. “It became such a stressor. I didn’t want to talk about it, but it has been helpful to talk about it more with people to feel less alone in the process. You feel really powerless when you’re just one person calling the servicer, but we see what can happen when people come together and fight.”

Sarah and Travis Rother — $130,000 forgiven

Both educators in Eastern Carver County, the Rothers —Sarah, a media specialist, and Travis, an English teacher — had significant debt from their education journeys.

“We are both lifelong learners who are dedicated to growing as educators,” said Sarah. “We both had undergrad loans, Master’s degree loans and specialist degree loans.”

Sarah attended one of Education Minnesota’s Degrees, Not Debt sessions and learned about PSLF and applied.

“However, I did not have the right type of loan or the right type of payment plan,” she said. “PSLF was so limited and confusing before the Biden administration waiver. Because of that previous attempt, I was in the system when the waivers were announced.”

Sarah still tried to do what she could to qualify before the waivers. She attempted to get on an income-driven payment plan, but got confusing and inaccurate communications from Navient, her loan servicer.

“The first estimate that my loan servicer gave me showed an ‘initial payment’ of $2,875,” she said. “I was shocked. It was what they expected me to pay every month. But on the same page, they also showed a maximum payment of $500 a month. I felt like I was being misled.”

Once the waivers were announced, the Rothers still started at the beginning of the process and Sarah dug into what was needed at every step. She attended virtual meetings, surrounded herself with information and resources and used the “PSLF help tool” on the Federal Student Aid website to get started.

“I was so distrustful of the entire process that I didn’t want to be denied because of a technicality,” Sarah said. “I was meticulous about every step. They denied me once, they were not going to turn me down again.”

Travis then went through the same process.

One day, Travis received a letter in the mail with the news that his loans were forgiven. The feeling of mistrust came back for Sarah, who hadn’t received anything yet.

“I took a deep breath and logged in online and had the same letter in a PDF,” she said. “I experienced such a tidal wave of relief and joy.”

Between the two of them, the Rothers had $130,000 forgiven.

“We truly started this whole journey to model a healthy relationship with money for our daughters,” said Sarah. “It feels like we are able to do that now. We hope they can see education as a gateway to their future, not as shackles of insurmountable debt.”